Questions

Questions:

- Can we create a forward curve for the difference of two assets which are listed on exchanges WITHOUT using the exchange forward curves ?

- Can such a modeled forward curve act as an alpha generator to help arbitrage ?

Approach:

- We considered the two assets - CME Henry Hub and ICE TTF

- We used the nearest futures contract to calculate the spreads

- We followed a supervised learning approach, compared performance in the validation set and performed hyper parameter tuning of the model

Model & its Implications

- We considered the nearest futures contract for both the assets and then multiplying with conversion factors converting them into same units

- To adjust for the differences in the currency, we made sure both the assets are converted into one single currency

- The spread values are then calculated historically by just calculating the difference and the data is unbiased

- We split the data into three sets for modeling purposes – training, validation and test

- We prioritized both the performance of the model in the validation set and the learning rate of model in the model selection

- We decided to test the spread curve in real time by comparing the estimates based on the test data vs the actuals

Performance

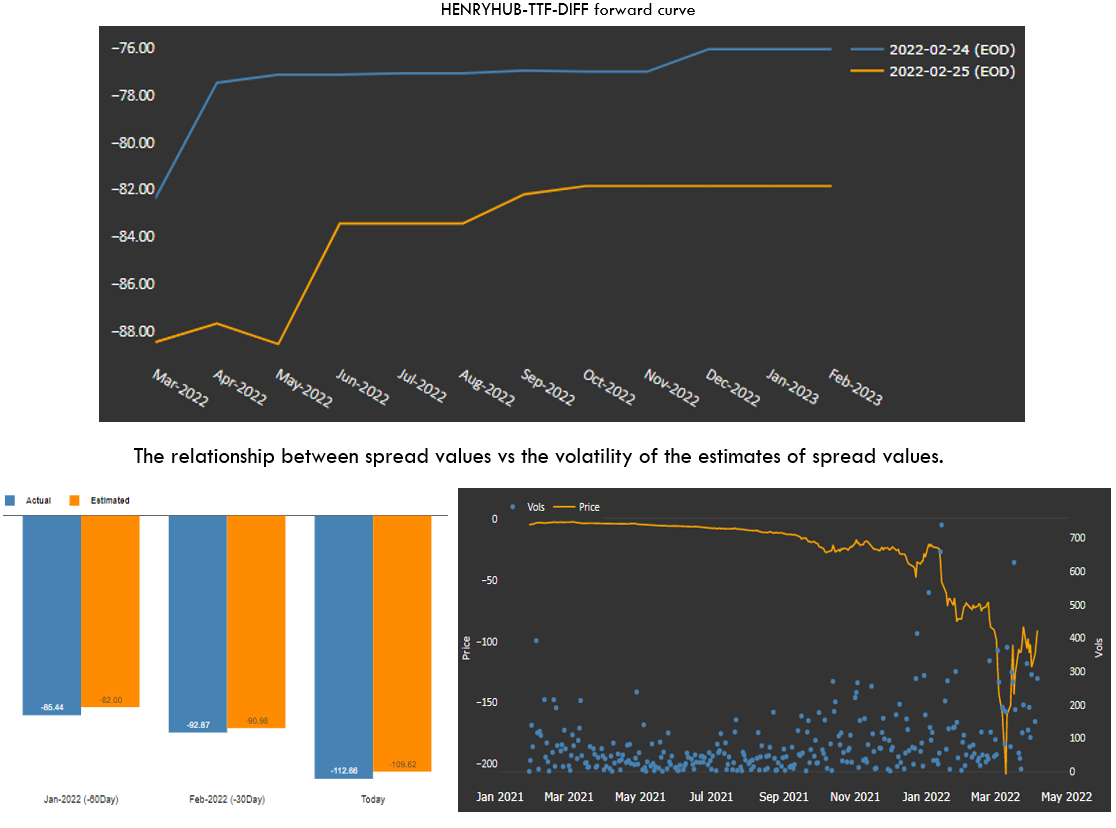

- As seen in the estimates vs actuals chart, the values of estimates are very close to the actual values

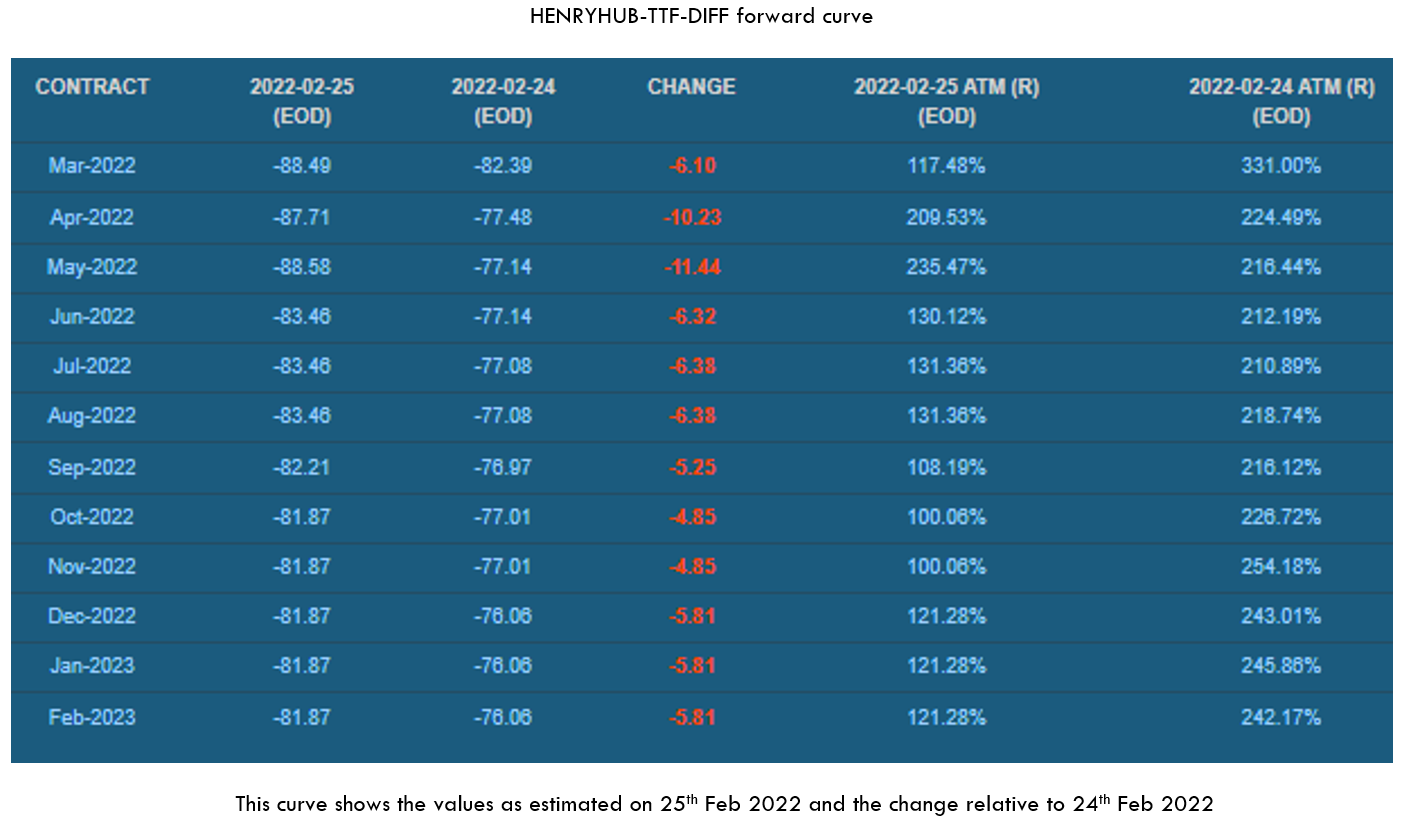

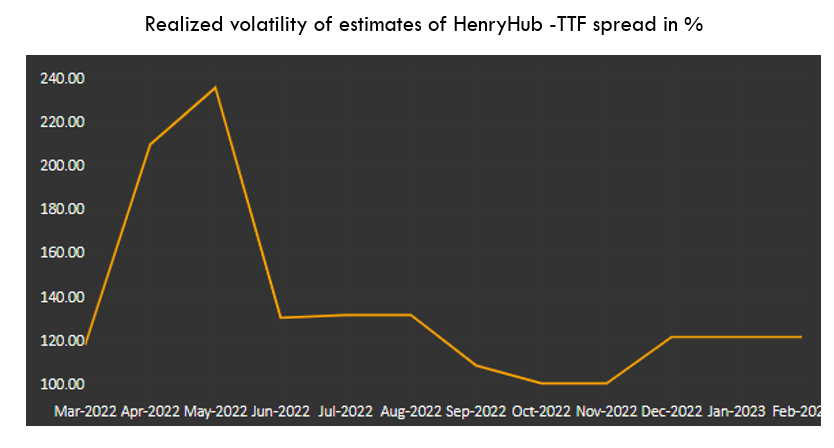

- According to the market reaction towards the end of Feb 2022, the key takeaway from the forward curve is that the spread would reduce with time, however, this could totally change with evolving market conditions

- The key takeaway that spread would reduce with time is generally used to find arbitrage opportunities for alpha generation

- If this specific example, as the spread is expected to narrow down, once could long the TTF while short the Henry Hub and vice-versa if the spread is expected to widen

- The significant changes in the spread occurs generally when the fundamentals behind one of the assets change and in an economic scenario affecting both the assets, spread may remain consistent

Conclusions

- Inter-commodity spreads are generally used by traders for arbitrage purposes - taking long-short positions at the same time in two similar assets to capitalize on the price discrepancies

- The forward curve and the volatility term structure for such spreads helps with decision making and timing of the decision to generate the alpha

- Clients can create their own custom curves for any inter-commodity spreads by just selecting those two assets using

platform

platform - The ability to generate a forward curve automatically every day for such spreads with the estimates and actuals being close to each other adds to the strengths of

Curves

Curves - Other strong functionalities of

Curves include building forward curves for fundamental factors, illiquid and exotic commodities

Curves include building forward curves for fundamental factors, illiquid and exotic commodities